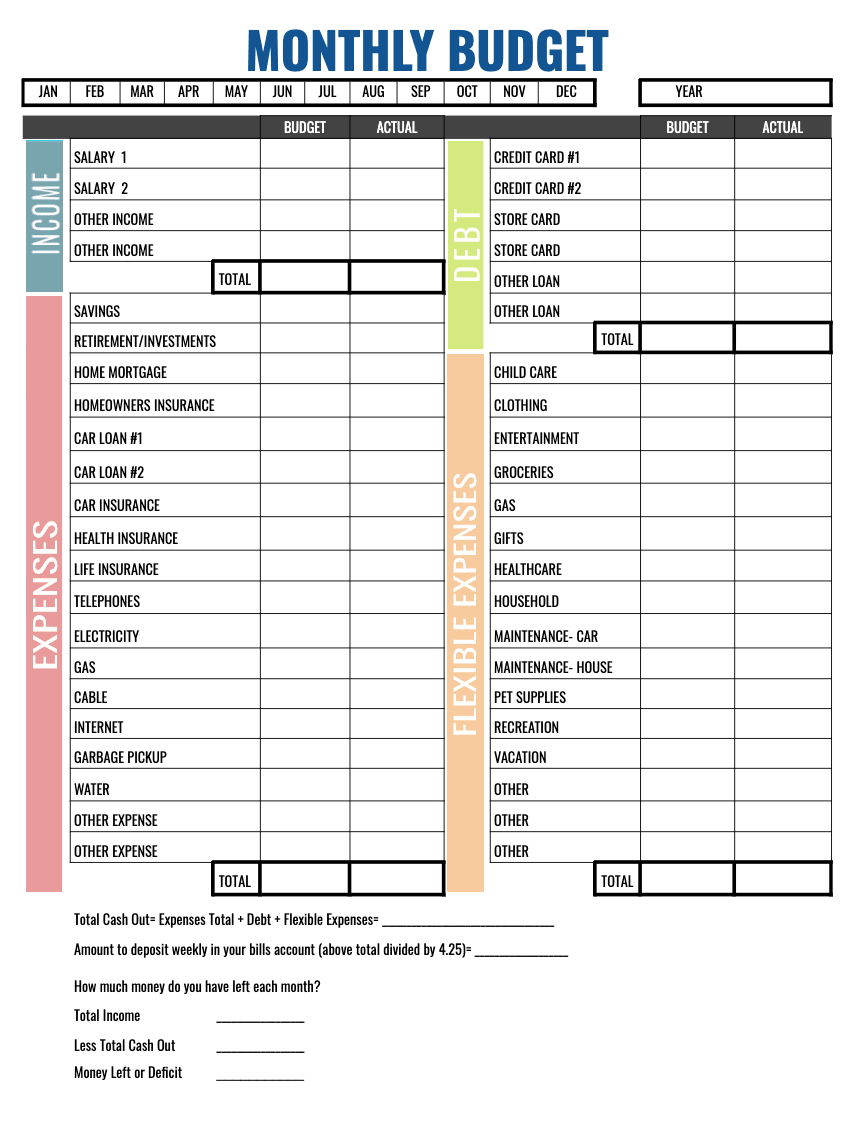

A personal or household budget is an itemized list of your expected income and expenses that helps you to plan for how your money will be spent or saved, as well as track your actual spending habits. The word budget makes some feel like they are in a corner on their spending but it is wise to know where your money is actually going. You may be surprised to see how much money you spend on Coffee and Lattes!! We have provided a FREE printable Monthly Budget worksheet template for you to print out and use. Even though we are in a digital age, it is easier to see things on paper printed in front of you and its easy reference if you keep these monthly budgets in a nice binder

Free Monthly Budget Worksheet Printable or Template

MONTHLY BUDGET WORKSHEET PRINTABLE HERE

A budget is really just a tool to gain a better and more accurate insight into your spending habits. By listing all of your sources of income against all of your monthly expenditures, you get a true picture of your personal cash flow, which will allow you to make better and more informed financial decisions. An accurate budget will also help you to better understand what you can and cannot afford.

If you're finding your financial situation is changing due to an unforeseen economic downturn or job loss or you wish to begin investing more money or are finding yourself using a credit card often, now is a good time to get familiar with these resources and get ahead of your budget to keep your family out of debt and using your money wisely by investing the extra money you do have.‹›

How to Use Monthly Budget Worksheets & Templates

As everyone's financial situation is different, you may find that not every category in these worksheets below is applicable to your income or spending. You may even recognize that some months are different than others, but you should find after going through this exercise that you are more prepared for those changes and that you're accounting for unanticipated expenses as well. Here is a breakdown of the Monthly Budget Template.

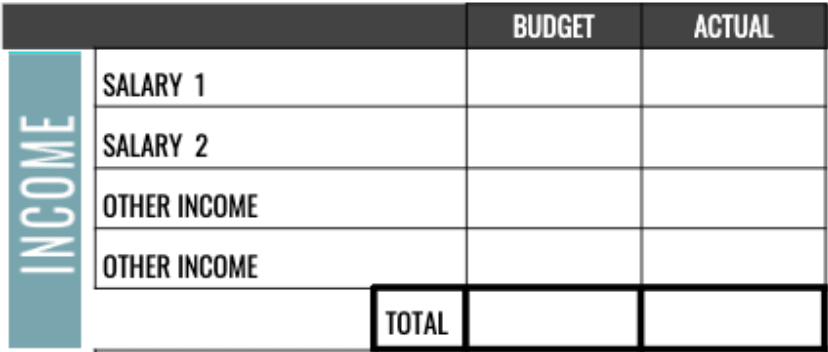

INCOME SECTION:

Though a monthly budget cycle is generally the most reasonable timeframe for which to set up an initial personal or household budget, there are many sources of income and expenses that do not perfectly follow a monthly schedule. For instance, you may receive a paycheck every week or two weeks, not once a month.In that case, calculate how that adds up over one month's time and write that in the appropriate row and column. You may also have certain expected or even recurring expenses that occur more or less often than monthly. To account for those expenses (like car insurance or property taxes) in your monthly budget, simply calculate the total expense for the calendar year and divide that by 12 in order to find the “monthly” expense. Write that number in the appropriate row and column.

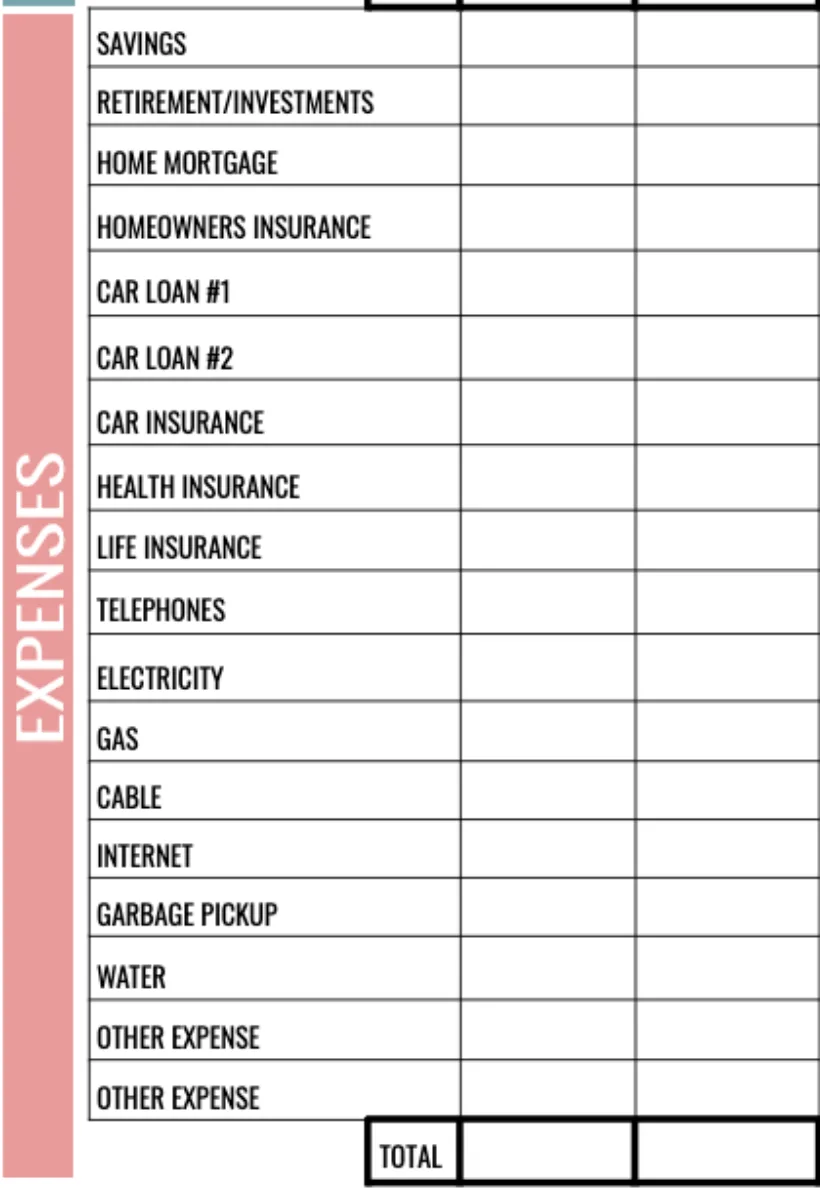

EXPENSES:

This category has items that are mainly fixed for every household. Some of these items can be decreased if you are diligent in checking the competition such as Car Insurance and Cable. Listed first are Savings & Retirement/Investments for a reason. You should have a savings account for those unexpected maintenance expenses or in case of a job loss. The rule of thumb is to save 10% of your income but start somewhere that you can fit in to your budget, even if you have credit card debt. Having a savings account helps you from having to use a credit card. It is recommended to have a separate savings bank account. Retirement/Investments should also be high on your list. Even if you can only afford $25 per week, it is still someting you are saving towards your retirement. The rest of the items in this category are pretty straightforward.

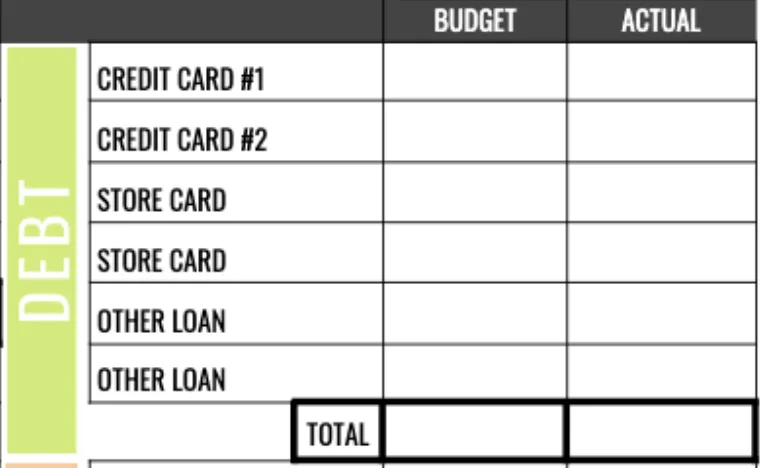

DEBT:

Credit Cards and Loans need to be paid down as soon as possible as you are paying interest on borrowing that money. That interest money you are spending can be making you money in an investment or buy you somehting for your home and family. Having a savings account will help you avoid from creating debt.

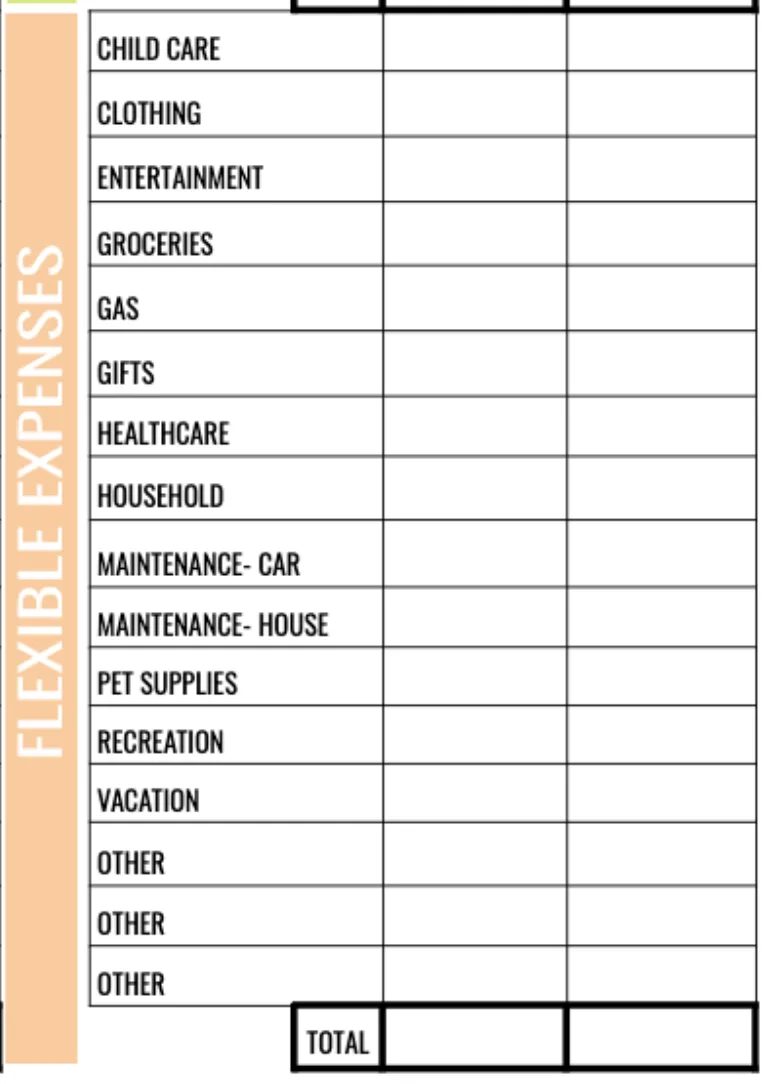

FLEXIBLE EXPENSES:

This category is more specific to your families needs such as child care, gas, entertainment, groceries etc. These expenses can be cut the easiest such as using coupons for groceries, shopping at places such as BJs Wholesale or Tops Markets to get less expensive gas or earn gas points, buying laundry detergent and personal supplies on Saturdays using a $5 off $25 in our Dollar General Coupon Deals, maximizing your grocery budget, spending summer holidays at home instead of vacationing etc. Make sure to check out the Weekly Ads every week to find the best grocery sales!

You've Completed the Budget Worksheet, What Now?

Should you find that at the end of the month that you are consistently spending more than you are bringing in, it might be time to take a closer look at where you're spending your money and adjust those areas where you can to make up the difference. The printable monthly budget template makes this easy to refer to and see what spending seems high. Should you find, on the other hand, that you consistently have money left over every month, you now have the opportunity to decide what to do with that extra cash. Perhaps you need to build up an emergency or “rainy day” fund. You could also be contributing more to your retirement savings. Consider paying off certain loans faster, or perhaps you can start saving up for a special or large purchase. To make this process easier, you can also use the Mint.com app which is free for you and I will get rewarded for sharing! It will categorize your spending (once you tell it which category the expenditure belongs in) and will make it easier to fill in the sheet. You can also make your budget right in the app, however, the printable sheet is great to reference month to month to see where your adjustments are needed. Read the Best Free budgeting apps here if you would like more digital options!

15 Free Budget Printables to Track Your Family's Expenses

Tuesday 28th of June 2022

[…] via Coupons (and Recipes) for Your Family […]

PRINTABLE BUDGET PLANNER FOR 2021 | 360NG

Thursday 11th of February 2021

[…] Free Monthly Budget Worksheet Template from Coupons for Your Family is an excellent choice for those that are new to budgeting. When you first start trying to put a […]