A personal or household budget is an itemized list of your expected income and expenses that helps you to plan for how your money will be spent or saved, as well as track your actual spending habits. The word budget makes some feel like they are in a corner on their spending but it is …

Money Tips

How does Ibotta work? Ibotta allows you to earn cash each time you shop! And you don’t have to cut any coupons. Simply select your offers in the Ibotta app before heading to the store then buy those items and get cash back. Also earn percentages cash back on online purchases with special promos from …

It’s Back!! Unleash the Power of Entertainment with this Hulu Black Friday Promo! Looking for unlimited access to a vast library of entertainment? Look no further than Hulu! With this Hulu Black Friday Promo Deal, you can unleash the power of entertainment and indulge in your favorite TV shows, movies, and more for only $.99 …

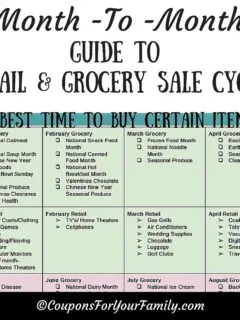

Print this awesome Monthly Guide of Best Time to Buy just about anything! When is the best time to buy a car, or the best time to buy tv, or the best time to buy frozen foods or the best time to buy a laptop? It is proven fact that certain times of the …

Grab Paramount Plus Essential for the price of $1.99 per month! Paramount+ is an American subscription video on-demand over-the-top streaming service owned and operated by ViacomCBS Digital, a subsidiary of ViacomCBS. Watch thousands of episodes of your favorite shows on any device. Paramount Plus plans include on-demand and live content from CBS, BET, Comedy Central. Right now the …

What is the Upside App & How it works: The Upside Cash Back App is a mobile application that allows users to earn cash back on purchases made at participating stores and restaurants. Is the Upside App legit? YES – The app partners with a wide range of retailers and restaurants, including popular chains like …

Get 2000 points ($2 value) on the Fetch Rewards App with referral code! The Fetch Rewards App allows you to earn points for just about EVERY receipt you upload. Right now you can get 2000 Bonus Points AND give 2000 points to each of your friends by using this Fetch Rewards referral code- UG2GX. I just …

7 Ways to Stop Living Paycheck to Paycheck It may seem like a very hard thing to do, but there is a way for you to stop living paycheck to paycheck—it just requires a lot of hard work. If you dream of a day when you don’t have to worry about when you can afford …

If you’re an avid online shopper, you know that promo codes can save you a ton. Why would you buy something at full retail price, when you could own it for a fraction of the cost? Part of the beauty of online shopping is that it’s easier to compare deals than actually going to the …

Acorns investing app is your app to financial wellness. It will help you invest, save and spend smarter at just $1-$3 per month. Acorns helps you grow your money with their Round Up feature. All you have to do is link your Acorn account to bank account and your spare change will fund your …