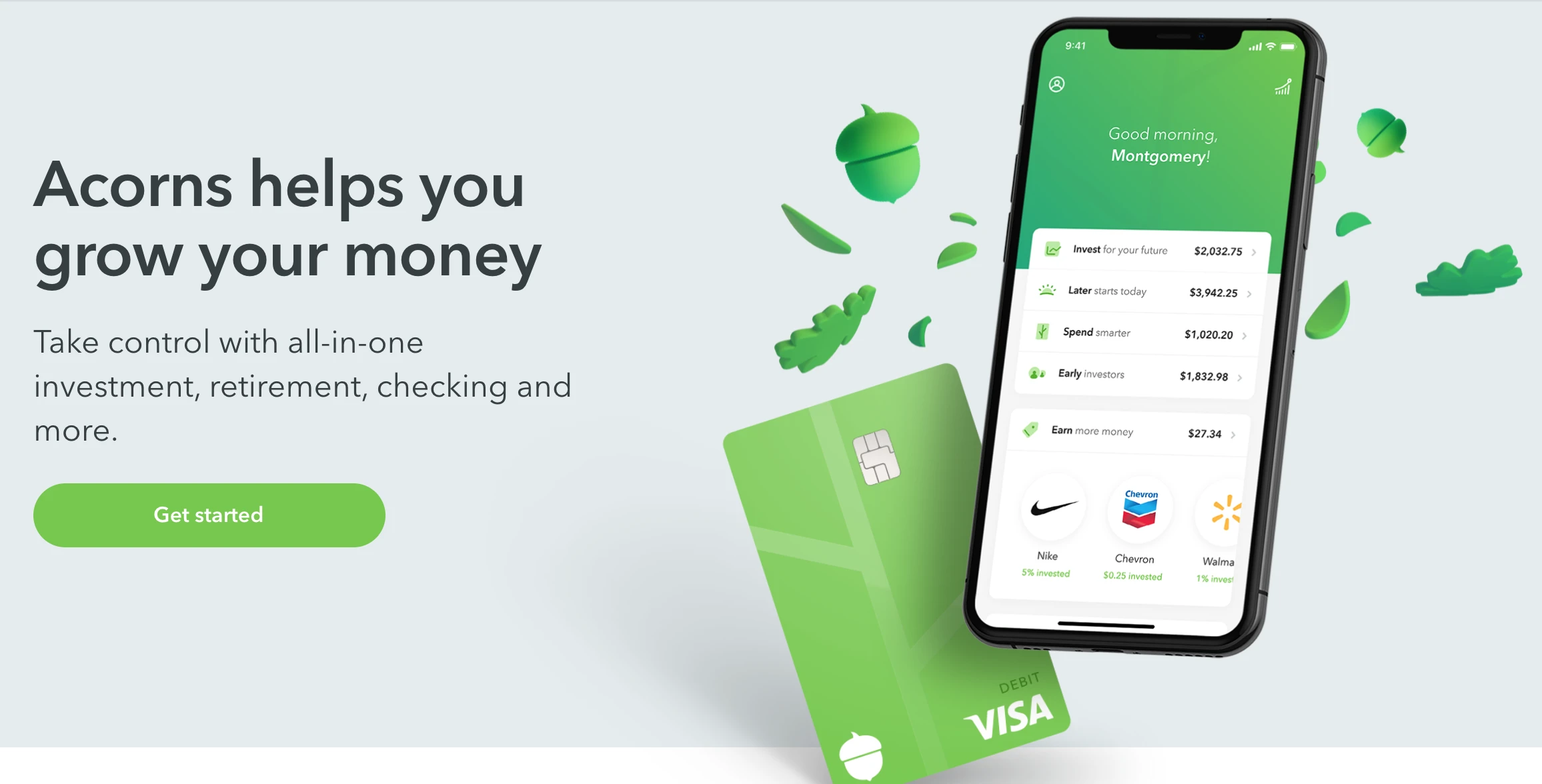

Acorns investing app is your app to financial wellness. It will help you invest, save and spend smarter at just $1-$3 per month. Acorns helps you grow your money with their Round Up feature. All you have to do is link your Acorn account to bank account and your spare change will fund your investment account. Invest spare change, save for retirement, save and invest when you spend, earn bonus investments and much more. How much does Acorns Investing Cost?

How much does Acorns Investing Lite Plan cost? only $1 per month

Getting started? Invest spare change, set Recurring Investments, and more with an easy, automated investment account.

Sign up todayAcorns Investing Personal Plan- $3 per month

All-in-one investment, retirement, and checking, plus a metal debit card, bonus investments, money advice, and more.

Sign up today Invest- Investment account

Invest- Investment account Later- Retirement account

Later- Retirement account- The easiest way to save for retirement

- Earn tax advantages

- Updated regularly to match your goals

Spend- Checking account

Spend- Checking account- Save money with no account fees and 55,000+ fee-free ATMs nationwide and around the world

- Earn more with up to 10% bonus investments

- Invest automatically with built-in investment and retirement accounts

Acorns Family Plan- $5 per month

Investment accounts for kids, plus personal investment, retirement, and checking accounts, and exclusive offers and content.

Sign up today Invest- Investment account

Invest- Investment account Later- Retirement account

Later- Retirement account Spend- Checking account

Spend- Checking account Early- Investment account for kids

Early- Investment account for kids- Open in under 3 minutes

- Multiple kids at no added cost

- Automatic Recurring Investments

- Exclusive bonus investments

- Family financial advice

- Potential tax savings while they grow

- Flexibility with the funds